Former Premier League Stars Lose Millions in Failed Investments

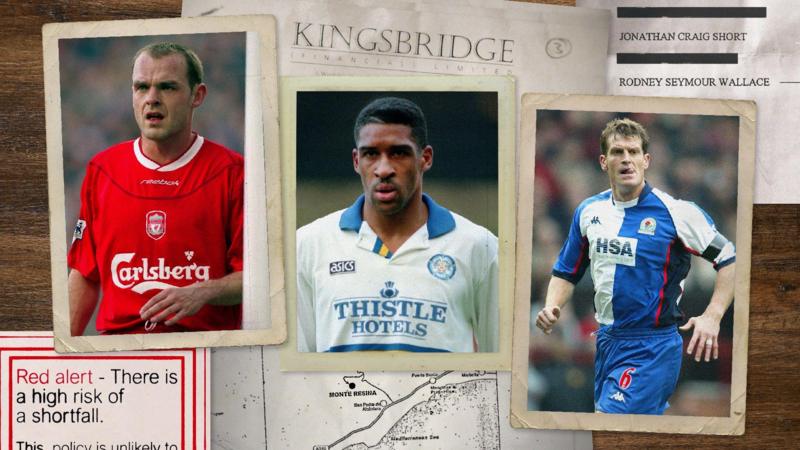

In the world of football, where the bright lights of stardom often shine the brightest, the darker undercurrents of financial mismanagement remain one of the less talked about yet critically pervasive issues. Recently, former Premier League footballers, Danny Murphy, Brian Deane, and Craig Short, have brought attention to this pressing matter, claiming that they have been victims of what they term as "financial abuse."

The allegation stems from bad financial advice and investment schemes that the players claim have significantly impacted their financial well-being and post-retirement quality of life. This isn’t an issue isolated to just these athletes; it underscores a broader systemic problem within the sports industry, where players are often ill-prepared to handle their finances, becoming susceptible to predatory schemes.

Danny Murphy, renowned for his intelligent playmaking skills at clubs like Liverpool and Fulham, emphasized the betrayal felt when athletes, who concentrate their energies on their sports careers, place their financial trust in advisors who fail to act with the players' best interests at heart. Murphy pointed out that during his playing years, the focus was almost exclusively on performance and physical health, with little to no emphasis on financial education or the management of their earnings.

Brian Deane, a striker who etched his name into Premier League history by scoring the first-ever goal in the competition, shared a similar narrative. Post-retirement, Deane discovered that several investments he had entered, advised by financial managers supposedly acting on his behalf, had failed, leaving him in precarious financial straits. What was particularly disheartening for Deane was the realization that more immersive knowledge about financial management during his playing days might have shielded him from such pitfalls.

Craig Short, who displayed his defensive prowess across several English clubs, also shared insights into the struggles he faced transitioning from a salary-earning player to retirement — a phase often marred by poor financial choices guided by misadvice. His experiences highlight the need for current players to receive comprehensive advice that encompasses both their immediate financial needs and long-term financial health.

The recurring theme in their stories is not just the personal financial loss but the emotional and psychological toll it exacts. Athletes, who dedicate a significant portion of their lives to mastering their sport, often find themselves in challenging circumstances once their professional careers end. The abrupt change from a structured sporting world to navigating the convoluted realm of financial planning can be overwhelming.

This situation calls for a crucial reflection within sports governance. Institutions, clubs, and governing bodies bear the responsibility not just for a player's physical and technical training but also for ensuring they receive robust financial education. The implementation of mandatory financial literacy programs for athletes is one mitigative strategy that could be adopted. These programs must be comprehensive, covering topics from investment risks to financial planning and should be tailored to the unique trajectory of sports careers, which unlike most professions, often peak early and can be short-lived.

The testimonies of Murphy, Deane, and Short serve as a stark reminder of the vulnerabilities professional athletes face in the realm of financial management. It’s a call to action for all stakeholders in sports — from management to players' associations — to intensify their efforts in protecting athletes from financial misadventures.

The evolution of sports involves not just refining the game but also ensuring the holistic well-being of those who play it. By fostering an environment where athletes are as savvy with their finances as they are skilled in their sports, the industry can safeguard the legacy and the lives of those who have given their all to the game.